Account Details

You can use the CoreCard API to retrieve general account information, such as the primary currency code, the overlimit credit, various fees balances, the credit limit, the past due amount, the minimum payment due amount, the current balance, the statement format (i.e., physical, digital, or paused), the date the account was opened, the program ID, and the number of days in the cycle. You can obtain details of the available credit limit and cash credit limit using the API (see the GetAccountDetails API).

Additionally, you can add a status to the account for a specific time period. Once the manually applied status expires or another status is added, the account status will be updated.

You can use the API to obtain details of an account credit strategy. The account credit strategy determines whether the account has overlimit protection, how the overlimit protection is being used for various merchant category groups for card-present and card-not-present transactions. You can also obtain information about the past due days permitted to charge off the account.

You can perform a delinquency re-age on account to make it a regular, operational account. The delinquency re-age can either be executed as a full re-age or a partial re-age using the CoreCard API. The API also returns the delinquency history of a card account.

You can define various attributes on different plan segments, such as charging different interest rates and fees. You can use the CoreCard API to obtain or update the details of a plan segment.

You can manage fees such as interest, late fees, card fees, membership fees, message fees, overlimit fees, and service charges to be applied or waived for a certain period or permanently.

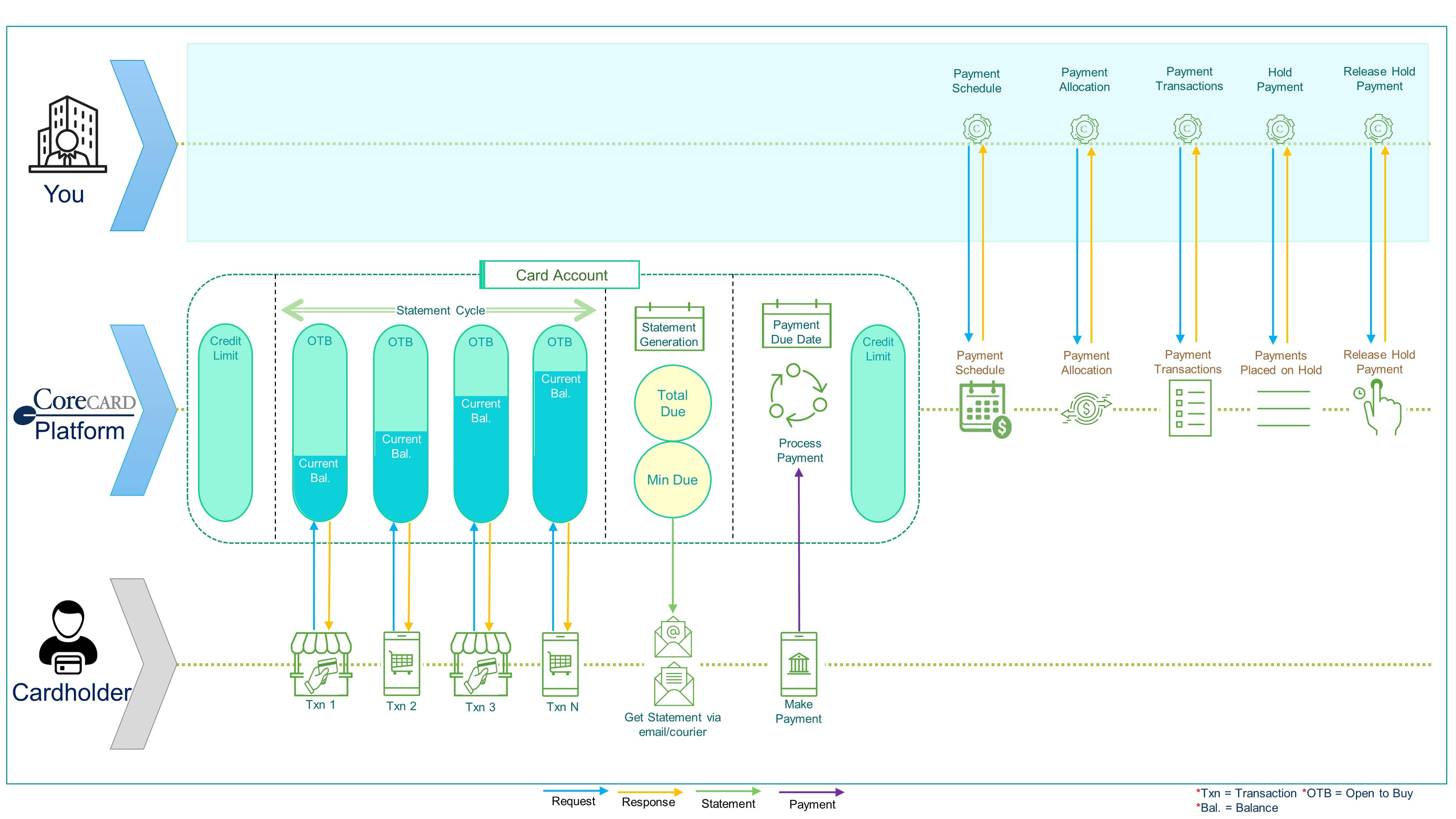

The CoreCard system also allows the creation of payment hold rules with different parameters and to obtain the hold payment details, such as the payment schedule ID, hold amount, payment post date and time, hold status, number of payments on hold, and the total amount of payment on hold. You can also use the API to release a payment from a hold status by providing an account number and the specific transaction ID.

You can use the CoreCard API to control compliance-related rule attributes to make your card program operational in a specific geographic location. For example, federal or state regulations such SCRA, MLA, and Reg O must be followed in order for a card program to be operational in the United States.